Introduction

As most know, President Donald J Trump issued three executive orders on February 1st, imposing:

- A 25% tariff on Mexico and Canada (reduced to 10% for Canadian oil).

- A 10% tariff on China.

Canada responded with a 25% tariff on CAD 155 billion worth of U.S. imports. At the time they were announced, it was said that the tariffs would be phased in, starting with CAD 30 million on February 4th, with the balance coming into effect within 21 days after public consultation.

Mexico also threatened a 25% retaliatory tariff on U.S. goods, though the specifics at that time were unclear.

On February 3rd, Canada and Mexico each successfully negotiated a 30-day pause on tariff implementation. China, however, responded on February 4th with retaliatory 10% tariffs effective February 10th, alongside other non-tariff measures.

It was particularly interesting to learn of President Trump’s rationale for imposing tariffs on Canada and how his thinking could impact international tax policy, including Canada’s Global Minimum Tax Act (the legislation that implemented into Canadian domestic law the global minimum tax under Pillar Two as developed by the Organization for Economic Co-operation and Development).

The goal of this post is to examine the President’s rationale for imposing tariffs, objectives and discuss how Canada and Canadian businesses should respond.

Since the original writing of this article, President Trump issued an executive order on February 10, 2025 imposing a 25% tariff on all foreign steel and aluminum imports, including steel and aluminum from Canada, effective March 12, 2025. The order cites national security concerns as the justification for invoking section 232 of the Trade Expansion Act of 1962, arguing that the U.S. must reduce its reliance on foreign steel to protect critical industries such as defense, infrastructure, and energy. The President explicitly criticized Canada, claiming that Canadian steel benefits from government subsidies and other interventions, making it an “unfair competitor” to U.S. steel producers.

The Executive Order (February 1, 2025) – what does it say?

The President’s February 1st executive order (EO) against Canada relies on the powers afforded to the President by the Constitution and by the laws of the United States of America, including the National Emergency Act (NEA), the International Emergency Economic Powers Act (IEEPA), and the Trade Act of 1974.

The EO extends the emergency declaration Declaring a National Emergency at the Southern Border made on January 20, 2025 regarding the influx of illegal aliens and illicit drugs into the United States, to include Canada. The justification? Canada allegedly poses a threat to the safety and security of Americans.

The basis for the Executive Order

The EO cites two primary concerns:

- The public health crisis caused by fentanyl and other illicit drugs.

- Canada’s purported shortcomings in combating drug trafficking organizations (DTOs), human traffickers, and organized crime.

Using these justifications, the President invoked the IEEPA to impose tariffs, arguing in the EO that Canada represents an:

“Unusual and extraordinary threat (sourced in substantial part outside the United States) to the national security and foreign policy of the United States.”

The IEEPA allows the President to bypass Congress, granting him the unilateral power to impose tariffs.

Key observations on the Executive Order

- The EO explicitly warns Canada that retaliatory tariffs could lead to expanded U.S. tariffs. Despite this, Canada moved forward with countermeasures.

- The EO states that tariffs will be lifted if Canada takes “adequate” steps to address the public health crisis through “cooperative” enforcement actions.

- The EO indicates that the President will determine whether Canada has taken “sufficient” action based on recommendations from Secretary of Homeland Security Kristi Noem.

The language of the EO strongly suggests that the President views Canada as a major conduit for fentanyl smuggling and a haven for organized crime.

Does Canada pose an “unusual and extraordinary threat”?

The data suggests otherwise. Let’s analyze immigration and drug smuggling statistics.

U.S. Customs and Border Protection encounters

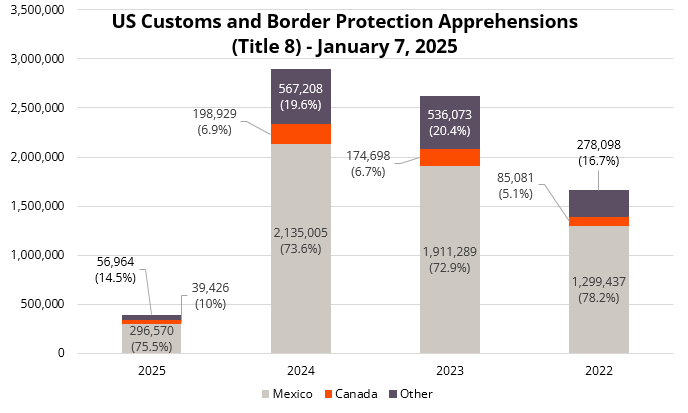

The U.S. Customs and Border Protection (CBP) statistics for apprehensions (Title 8) between 2022–2025 paint a clear picture.

Key Takeaways:

- Canada accounted for a small fraction of total U.S. apprehensions between 2022 and 2025.

- Although northern border crossings have increased, the overall percentage remains small compared to the southern, eastern, and western borders.

- Does this justify an “unusual and extraordinary” designation? The data suggests no.

Fentanyl smuggling – Is Canada the problem?

The President’s EO heavily emphasizes fentanyl smuggling as a major issue, implying that Canada is a major source.

But what do the numbers show? (USAFacts, How much fentanyl is seized at US borders each month?)

Breaking down the data:

- Mexico remains the largest source of fentanyl entering the U.S.

- Other entry points, including international airports and seaports (e.g., Miami), account for a significant share.

- Canada’s share is minimal in comparison.

If the U.S. struggles to control fentanyl smuggling at its ports and southern border, why is Canada being singled out?

The evidence suggests that Canada does not pose an “unusual and extraordinary threat.”

Canada’s response to border security

The President’s EO downplays Canada’s ongoing efforts to secure its borders.

Key Canadian actions:

- On December 17, 2024, Canada announced a CAD 1.3 billion investment in border security over six years.

- Immigration reforms include:

- Stricter visa policies.

- Expanded authority to cancel or suspend immigration documents.

- A streamlined asylum system.

Given Canada’s relatively minor role in fentanyl smuggling, these policy actions should have been more than sufficient to address U.S. concerns.

What is the real reason for the tariffs?

The President has consistently expressed admiration for tariffs, often touting them as a tool to boost U.S. manufacturing and a revenue source to offset deeper U.S. income tax cuts.

The President’s vision for tariffs:

- Tariffs will force companies to move manufacturing to the U.S and incentivize existing U.S. manufacturers to invest in domestic production rather than offshore.

- Foreign businesses that relocate to the U.S. will benefit from lower tax rates, with the President proposing a reduction of the corporate income tax rate from 21% to 15% as part of his economic strategy. (Source: Remarks By President Trump at the World Economic Forum)

- The President’s administration has proposed using revenue from newly imposed tariffs to offset the cost of further income tax cuts. His administration projects that tariffs will generate approximately $500 billion annually, which he argues will help fund proposed tax cuts. However, independent estimates suggest that a 10% universal tariff could generate around $2 trillion over a decade, while a 20% tariff might raise about $3.3 trillion in the same period (Source: Tax Foundation, Revenue Estimates of Trump’s Universal Baseline Tariffs, November 6, 2024). These figures fall short of the nearly $7.8 trillion in President Trump’s proposed tax reductions (Source: Tax Foundation, Questions about Tax Cuts, Tariffs and Reconciliation after the Election, November 13, 2024)

- The President is leveraging tariffs as an economic tool, rather than a military strategy, to advance U.S. interests.

- Tariffs are intended to encourage companies to shift manufacturing to the U.S. and incentivize domestic investment rather than offshoring.

At the World Economic Forum (January 23, 2025), the President reiterated his stance on using tariffs as a stick with the carrot being low tax rates:

“The President’s message to businesses worldwide is clear: manufacture in the U.S. to benefit from low taxes; otherwise, face tariffs that funnel revenue into the U.S. Treasury.”

The President has on more than one occasion mused that Canada should become the 51st state. He suggested he would use “economic force” to achieve his end goal. At a press conference that he held at Mar-a-Lago on January 7, 2025, he said:

Reporter: But sir, real fast, you said you were considering military force to acquire Panama and Greenland. Are you also considering military force to annex and acquire Canada?

President: No — economic force because Canada and the United States, that would really be something. You get rid of that artificially drawn line and you take a look at what that looks like, and it would also be much better for national security. Don’t forget, we basically protect Canada. But here’s the problem with Canada — so many friends up there. I love the Canadian people, they’re great. But we’re spending hundreds of billions a year to protect it. We’re spending hundreds of billions a year to take care of Canada. We lose — in trade deficits we’re losing massive — we don’t need their cars. You know, they make 20 percent of our cars. We don’t need that.

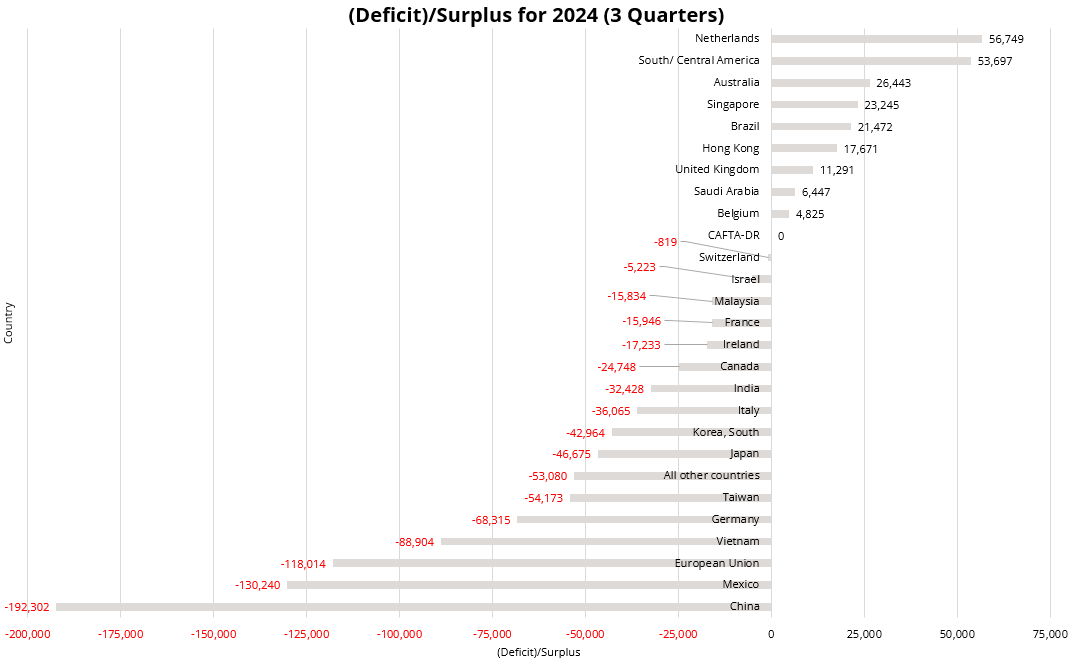

The President at that same press conference complained about the USD 200-250M deficit with Canada. However, when you review the US trade data and include not only goods but services the “trade” deficit is much lower (e.g. USD 40.9B (2023) when including services). The larger trade deficits are with China, Mexico, (European Union, largest deficit being with Germany), Japan, Taiwan, Italy, India, and South Korea.

Digging a little deeper on how the President is calculating the “deficit,” we located a CNN article “With Tariffs and Trade in the Spotlight, What the President Means When He Says America Is ‘Losing’ Billions to Canada, Others” dated January 16, 2025 which explains that the US calculation of the “deficit” (the lion’s share) arises from US defense spending and not trade.

The conclusion is that the President would prefer greater integration with Canada and for it, and other countries, to help bear common costs (including, defense costs). The threat of tariffs against Canada on the pretense that Canada is a threat because of immigration and fentanyl was a ruse since he needed to make that claim so that he could unilaterally impose tariffs without seeking congressional approval. The President will still try to gain access to Canada’s resources (oil and minerals) and will use the “economic” tools at his disposal to achieve his ultimate goal: greater integration of Canada into the US economy on his terms.

The President’s real interest in a new economic deal with Canada was confirmed as much in his February 3, 2025 Truth Social post where he wrote:

The President on Truth Social, February 3, 2025:

“As President, it is my responsibility to ensure the safety of ALL Americans, and I am doing just that. I am very pleased with this initial outcome, and the Tariffs announced on Saturday will be paused for a 30-day period to see whether or not a final economic deal with Canada can be structured. FAIRNESS FOR ALL!”

As recently as February 4th, the President again speculated about Canada becoming the 51st state. Notwithstanding the attempt to use tariffs as an economic force against Canada to force its annexation, Canadians have clearly indicated that they wish to maintain their sovereignty.

How should Canada respond?

Short-term actions:

- Increase military spending to meet NATO’s 2% GDP target, reinforcing Canada’s ability to defend its interests and maintain sovereignty in the face of external economic and political pressures. This also helps appease the President’s complaint about Canada’s underspending on defense, demonstrating that it is in our common interest to share the burden of collective security.

- Accelerate negotiations on Canada-United States-Mexico Agreement (CUSMA). Currently it is up for review on July 1, 2026.

- Review protectionist policies (e.g., Canada’s Online Streaming Act and supply management policies).

- Review Canada’s international tax policy (e.g., Canada’s undertaxed profit rule in the Global Minimum Tax Act and the Digital Services Tax Act).

Medium to long-term actions:

- Diversify trade partners to reduce reliance on U.S. exports and mitigate the impact of future trade disputes. Canada has been dependent on the United States for decades. For example, in 2024, Canada exported 75.9% of its goods to the United States (The Daily, “Canadian international merchandise trade, December 2024). Canada in the medium to long term needs to consider alternative markets for its goods and to reduce reliance on the US to purchase its goods (and services). Canada should think of measures that would help to develop the internal infrastructure to facilitate the access to these markets which includes incentivizing investment in the transportation infrastructure and removing interprovincial barriers that impede the movement of goods across Canada.

- Eliminate interprovincial trade barriers that restrict access to both domestic and foreign markets, particularly in key industries such as energy, manufacturing, and agriculture.

- Canadian companies should consider diversifying the manufacturing and process function to, or in part, service its US customers from facilities located in the United States. Canadian facilities can continue to serve the US markets, but this would help hedge tariff barriers. Canadian facilities could be used to serve the Canadian and foreign markets where there are no threats of trade barriers. The expansion into the United States could take many forms and could be undertaken in stages such as through partnerships with existing US businesses, joint ventures, contract manufacturing, or the establishment (or leasing) of facilities in the United States.

- Strengthen domestic supply chains by investing in infrastructure, critical minerals, and energy production to reduce reliance on imports.

- Incentivize investment in Canada from foreign businesses to facilitate a transformation of Canada’s economy by making it a more capital friendly jurisdiction. Canada has historically been an attractive destination for foreign direct investment boasting the second-largest foreign direct investment (FDI) stock-to-GDP ratio among G20 countries in 2023 (“Key facts about Canada’s competitiveness for foreign direct investment: Office of the Chief Economist“). However, current trends indicate a decline in FDI inflows. In 2023, FDI into Canada dropped by 42% to C$52.4 billion from the previous year (Reuters, “Canada risks losing investment to Mexico as labor productivity skids“, April 29, 2024). The process would include a review of corporate tax policies making Canada more tax competitive and streamlining regulations to attract foreign investment and retain Canadian businesses. For example, in the case of tax policy, Canada could:

- relax the definition of “taxable Canadian property.” Currently, non-residents are subject to Canadian income tax (subject to limited treaty relief) on the sale of their shares in Canadian private companies if the value of those shares is derived primarily from Canadian real estate. Canada should carve-out the gain on those shares where the Canadian real estate is used in an active business (e.g., manufacturing). The rules should be designed to ensure that the exemption is directed at foreign capital infusions.

- eliminate the proposed increase in the percentage of a capital gain subject to income tax from 66 2/3% to 50%.

- Pursue strategic trade alliances beyond North America, expanding agreements with Europe, Asia, and Latin America to reduce economic dependence on the U.S.

- Increase R&D and innovation funding to support sectors such as clean technology, artificial intelligence, and defense to ensure long-term economic resilience.

- Enhance national security and defense investments to reinforce Canada’s sovereignty and reduce economic and political leverage from foreign powers.

- Develop energy strategies to maximize the benefits of Canada’s natural resources while ensuring domestic economic stability.

- Strengthen diplomatic engagement with allies and international organizations to counterbalance U.S. economic pressure and reinforce Canada’s global standing.

Expanding these measures will help Canada maintain its economic sovereignty, reinforce its global competitiveness, and mitigate risks associated with unpredictable U.S. trade policies.

Conclusion

President Trump’s tariff justification is built on shaky premises. The data does not support Canada posing an “unusual and extraordinary” threat.

The real motivation appears to be economic leverage—not fentanyl or immigration concerns.

Canada must take proactive steps to protect its interests while maintaining sovereignty. Canadians should express pride and stand firm in the negotiations while maintaining a measured approach. It is important to avoid escalating tensions into a direct confrontation with President Trump, as framing the situation as a personal battle could undermine strategic objectives.